Ethereum, the second-largest cryptocurrency by market cap, often sparks curiosity. Predicting its price is a hot topic among investors and enthusiasts.

Understanding Ethereum’s price trends can help make informed decisions. Cryptocurrencies are known for their volatility, and Ethereum is no exception. Its price can change rapidly, influenced by various factors. These include market demand, technological advancements, and regulatory news. Predicting Ethereum’s future price involves analyzing these elements and identifying patterns.

For those new to cryptocurrency, it might seem complex. Yet, with the right insights, it becomes more manageable. In this blog, we will explore key factors and expert predictions. This will help you get a clearer view of Ethereum’s potential future. Ready to dive in? Let’s explore Ethereum price predictions together.

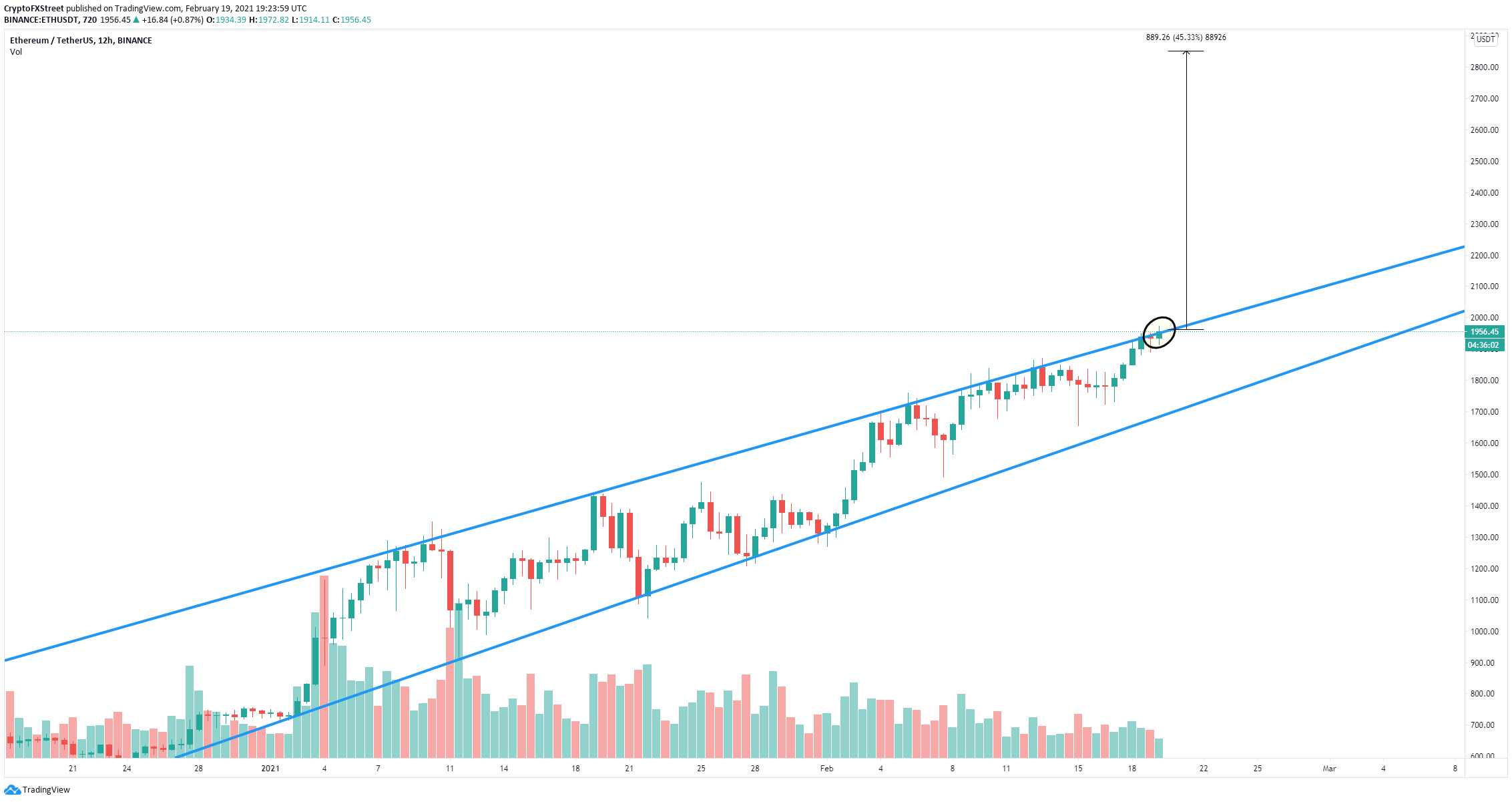

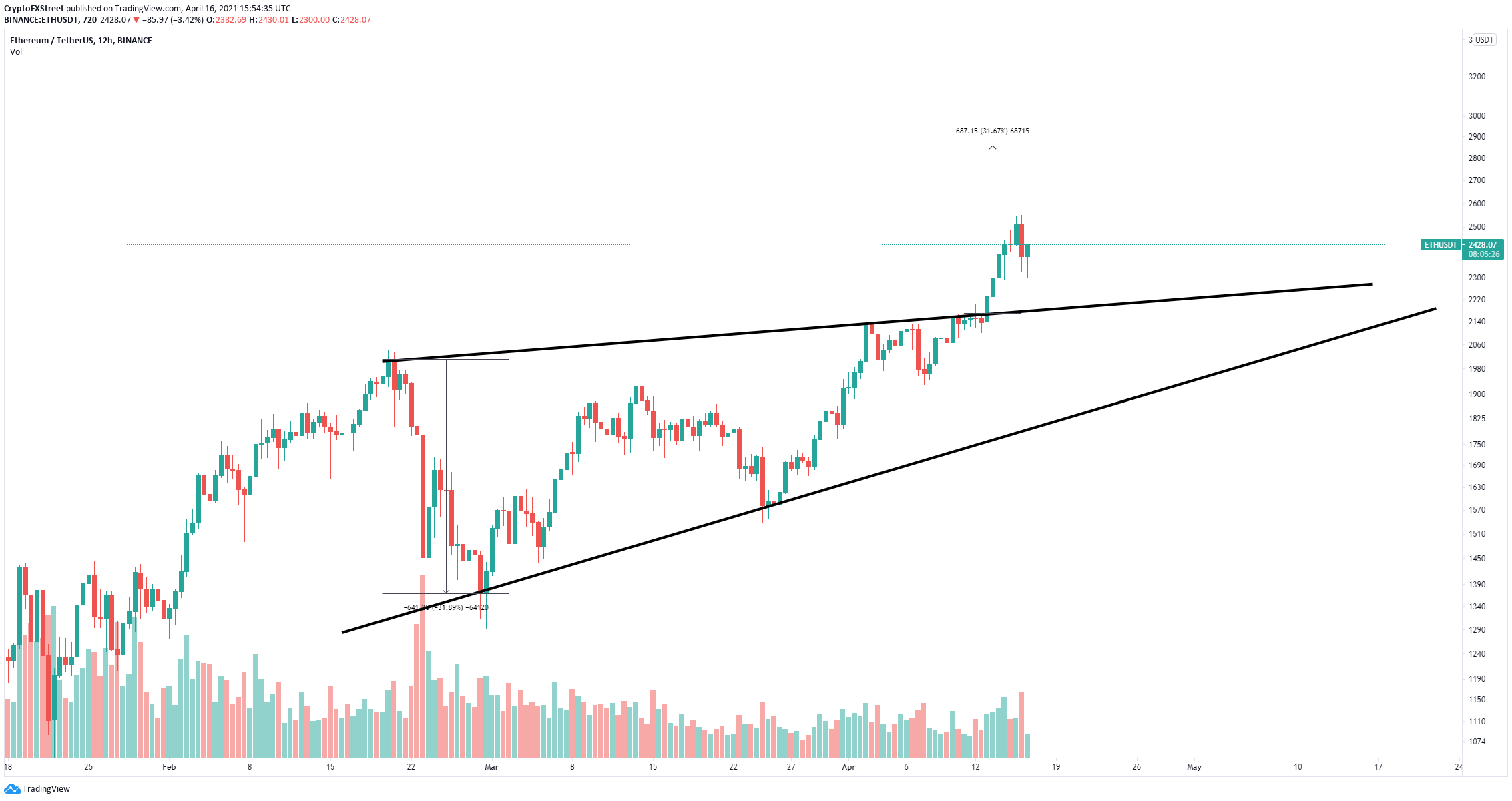

Credit: www.fxstreet.com

Introduction To Ethereum

Ethereum has become a significant player in the cryptocurrency market. It is not just about price; it has a vast ecosystem. Understanding Ethereum’s role helps in making informed predictions about its price.

What Is Ethereum?

Ethereum is a decentralized platform that runs smart contracts. These applications run without any downtime, fraud, or third-party interference. Ethereum was proposed in late 2013 by Vitalik Buterin. Development began in early 2014, and the network went live on July 30, 2015.

Ethereum allows developers to build and deploy decentralized applications (dApps). It uses its cryptocurrency called Ether (ETH). ETH is used to compensate participants who perform computations on the network.

Ethereum’s Market Position

Ethereum is the second-largest cryptocurrency by market capitalization, just behind Bitcoin. It is known for its strong community and developer support. This makes Ethereum a popular choice for new projects and initial coin offerings (ICOs).

Here’s a quick comparison of Ethereum and Bitcoin:

| Feature | Ethereum | Bitcoin |

|---|---|---|

| Year Launched | 2015 | 2009 |

| Market Cap | Second Largest | Largest |

| Primary Use | Smart Contracts and dApps | Digital Currency |

Ethereum’s popularity is due to its versatility and the ability to create smart contracts. Many new cryptocurrencies and projects are built on the Ethereum blockchain. This continuous development and innovation keep Ethereum at the forefront of the crypto space.

Investors often look at Ethereum’s market position to gauge its potential for future growth. The demand for ETH increases with the rise of new projects on its platform. This demand influences its price prediction and overall market value.

Historical Price Analysis

Understanding the historical price trends of Ethereum can provide insight into its future potential. In this section, we will examine the early years of Ethereum’s price movements and recent trends that have shaped its market.

Early Years

Ethereum was launched in 2015. Its initial price was under $1. This was a time of high interest and curiosity in the crypto world.

By the end of 2015, Ethereum’s price reached around $0.90. In 2016, Ethereum saw its first significant price increase. The value rose to over $10 by early 2017.

In 2017, Ethereum’s price experienced exponential growth. It peaked at around $1,400 in January 2018. This period marked Ethereum’s first major bull run.

Recent Trends

Ethereum’s price remained volatile from 2018 to 2020. Prices fluctuated between $100 and $400. This period saw many ups and downs due to market sentiment and technological developments.

In 2021, Ethereum experienced another significant price increase. The price reached an all-time high of around $4,300 in May 2021. This was driven by increased adoption and the rise of decentralized finance (DeFi) projects.

The following table summarizes Ethereum’s price movements over the years:

| Year | Price Range |

|---|---|

| 2015 | $0.60 – $0.90 |

| 2016 | $1 – $10 |

| 2017 | $10 – $1,400 |

| 2018 | $400 – $1,400 |

| 2019 | $100 – $400 |

| 2020 | $100 – $700 |

| 2021 | $700 – $4,300 |

By analyzing these historical trends, investors can better understand Ethereum’s price behavior. This knowledge can help predict future price movements.

Factors Influencing Price

Understanding the factors influencing Ethereum’s price is crucial for investors. Several key elements determine its market value. These include technology developments, market demand, and the regulatory environment.

Technology Developments

Technology advancements play a significant role in Ethereum’s price. Updates and improvements in the Ethereum blockchain can lead to higher efficiency and security.

For instance, the shift to Ethereum 2.0 aims to enhance scalability. This upgrade can make the network faster and more reliable. Such changes often attract more users and investors, boosting the price.

Market Demand

Market demand is another critical factor. The higher the demand for Ethereum, the higher its price.

Several elements influence market demand:

- Popularity of decentralized applications (DApps)

- Interest from institutional investors

- General market sentiment towards cryptocurrencies

Increasing demand from these areas can lead to a rise in Ethereum’s price.

Regulatory Environment

The regulatory environment also impacts Ethereum’s price. Regulations can either promote or restrict the use of cryptocurrencies.

For example, favorable regulations in major economies can boost investor confidence. This can lead to higher investments and a rise in price. Conversely, strict regulations can limit usage and lower the price.

Keeping an eye on regulatory news is essential for predicting Ethereum’s future value.

Ethereum 2.0 Impact

Ethereum 2.0 is a significant upgrade to the Ethereum network. It promises to improve scalability, security, and sustainability. Many investors are eager to see how these changes will affect Ethereum’s price.

Key Upgrades

Ethereum 2.0 introduces several key upgrades. The most notable is the shift from Proof of Work (PoW) to Proof of Stake (PoS). This change aims to reduce energy consumption. It also hopes to increase transaction speed. Another important upgrade is sharding. Sharding will allow the network to process more transactions in parallel. This will help reduce congestion and lower fees.

Potential Market Effects

The market effects of Ethereum 2.0 could be substantial. Improved scalability may attract more developers. This could lead to an increase in decentralized applications (dApps). Lower fees and faster transactions could attract more users. Increased adoption might drive up the demand for Ether. This could potentially lead to a rise in its price. Furthermore, the shift to PoS might reduce the selling pressure from miners. This could further positively impact the price.

Expert Predictions

Ethereum has garnered significant attention from investors and experts alike. Understanding Ethereum price predictions can help guide investment decisions. Here, we explore expert predictions, focusing on short-term and long-term forecasts.

Short-term Predictions

Experts predict that Ethereum’s price may show volatility in the short term. Market trends and investor sentiment will likely influence prices. Some analysts expect Ethereum to experience minor fluctuations. These changes could be due to market corrections or external factors.

Others forecast a steady growth path. They believe that Ethereum’s technological advancements will drive its value up. In the next few months, Ethereum could see a moderate increase. This optimism is based on the platform’s continuous development and adoption.

Long-term Predictions

Long-term predictions for Ethereum are more optimistic. Experts believe that Ethereum has strong potential for significant growth. They base their predictions on Ethereum’s robust infrastructure and widespread adoption.

Some foresee Ethereum reaching new heights in the next few years. They point to the platform’s ongoing upgrades and innovations. These enhancements could boost Ethereum’s scalability and efficiency. As a result, the price of Ethereum might see substantial gains.

Other analysts predict that Ethereum’s price could stabilize at higher levels. They argue that as blockchain technology matures, Ethereum will maintain its leadership. This stability could attract more institutional investors, further driving up its value.

Credit: www.youtube.com

Comparative Analysis With Bitcoin

Understanding the Ethereum price prediction often involves comparing it with Bitcoin. Both are leading cryptocurrencies, but they have different characteristics. This section will focus on a comparative analysis, examining key metrics like performance and market capitalization.

Performance Comparison

Both Ethereum and Bitcoin have shown strong performance over the years. However, their growth patterns differ.

| Metric | Ethereum | Bitcoin |

|---|---|---|

| Year of Launch | 2015 | 2009 |

| Peak Price (2021) | $4,865 | $64,863 |

| Average Annual Growth | 30% | 20% |

Ethereum has grown faster than Bitcoin in recent years. Its average annual growth is higher. This rapid growth is due to its versatile applications, including smart contracts and decentralized applications.

Market Capitalization

Market capitalization is another crucial metric for comparative analysis.

| Metric | Ethereum | Bitcoin |

|---|---|---|

| Market Cap (2023) | $450 billion | $1 trillion |

| Market Share (%) | 20% | 45% |

Bitcoin maintains a higher market capitalization. It is seen as a store of value, like digital gold. Ethereum, while smaller, is growing rapidly. Its market share is increasing due to the growing popularity of its blockchain.

In summary, Ethereum and Bitcoin offer different strengths. Ethereum is versatile and growing fast. Bitcoin is more established with higher market capitalization. Both have unique roles in the cryptocurrency market.

Risks And Challenges

Predicting Ethereum’s price involves understanding its risks and challenges. Ethereum faces several issues that could affect its future value. These issues include scalability and security concerns. Let’s delve deeper into these challenges.

Scalability Issues

Ethereum struggles with scalability. The network can handle only a limited number of transactions per second. This limitation slows down the system during high demand. Users experience delays and higher fees. As Ethereum grows, this problem becomes more pressing. Developers are working on solutions, but these take time to implement. Scalability remains a significant hurdle for Ethereum.

Security Concerns

Security is another major concern for Ethereum. The network has faced several high-profile hacks. These breaches have caused significant losses. Security vulnerabilities make users cautious. They may hesitate to invest or use the platform. Strong security measures are crucial for Ethereum’s success. Developers are constantly improving security, but risks still exist. The network must stay vigilant against new threats.

Credit: investinghaven.com

Investment Strategies

Investing in Ethereum can be both exciting and challenging. Understanding the right strategies can help you make informed decisions. This section will explore key investment strategies, focusing on diversification and risk management.

Diversification

Diversification means spreading your investments across different assets. This reduces the risk of losing money if one asset performs poorly. For Ethereum, consider investing in other cryptocurrencies as well. Bitcoin, Litecoin, and Ripple are popular choices. You can also invest in traditional assets like stocks and bonds. Diversification helps balance potential gains and losses.

Risk Management

Risk management is crucial for any investment. It involves assessing potential risks and planning to minimize them. Start by setting a budget for your Ethereum investments. Only invest money you can afford to lose. Keep track of the market trends and news. This helps you make timely decisions. Use stop-loss orders to limit potential losses. This automatically sells your Ethereum at a certain price. Stay informed and prepared to adjust your strategy if needed.

Frequently Asked Questions

What Affects Ethereum’s Price?

Ethereum’s price is influenced by market demand, technological advancements, regulatory news, and overall cryptocurrency market trends.

Is Ethereum A Good Investment?

Ethereum has shown significant growth potential, but it’s crucial to research and consider market volatility before investing.

How Often Does Ethereum Price Change?

Ethereum’s price can change frequently, often multiple times within a day, due to market dynamics.

What Are Ethereum Price Predictions?

Price predictions vary, with experts forecasting different outcomes based on technological developments and market trends.

Conclusion

Predicting Ethereum’s price involves many factors. Market trends, technology updates, and investor sentiment all play roles. While no prediction is foolproof, staying informed helps. Regularly checking credible sources is crucial. Investing wisely means understanding the risks. Research thoroughly before making decisions.

Ethereum has potential, but caution is key. Stay updated, stay informed, and invest smartly.