Bitcoin Price Prediction Bitcoin intrigues many with its volatile nature. Its price can change rapidly, often unpredictably.

Predicting Bitcoin’s future price is a hot topic. Investors and traders want to know where it’s headed. Understanding the factors that influence Bitcoin’s price can help make informed decisions. Market trends, news, and even tweets can impact its value. This blog will explore key elements that might affect Bitcoin’s price.

We will discuss expert opinions and market analysis. Stay with us to gain insights into Bitcoin’s potential future. Whether you are a seasoned investor or just curious, this guide will provide valuable information on Bitcoin price prediction.

Introduction To Bitcoin Price Prediction

Bitcoin price prediction involves analyzing market trends to forecast the future value of Bitcoin. This process uses historical data and various prediction models. It aims to help investors make informed decisions.

Bitcoin price prediction is a fascinating subject. Many people are curious about it. Understanding how Bitcoin’s value changes can be useful. It helps investors make better decisions. It also aids in understanding market trends. This blog post will dive into the basics of Bitcoin price prediction.Brief History Of Bitcoin

Bitcoin started in 2009. A person or group named Satoshi Nakamoto created it. It was the first cryptocurrency. Bitcoin was designed to be a decentralized currency. Unlike traditional money, it is not controlled by any government. In the early days, Bitcoin was worth very little. People traded it for fun. Over time, its value increased. By 2017, Bitcoin’s price reached almost $20,000. This caught the attention of many investors. Bitcoin’s price has been very volatile. It has seen many ups and downs. Understanding this history helps in predicting its future price.Importance Of Price Predictions

Price predictions are crucial for investors. They help in making informed decisions. Knowing when to buy or sell can lead to profits. It can also prevent losses. Predictions can also help understand market trends. They show how external factors affect Bitcoin’s price. For example, news about regulations can impact its value. Accurate predictions can boost confidence in the market. They provide a sense of stability. This attracts more investors. Overall, price predictions play a key role in the world of Bitcoin. “`

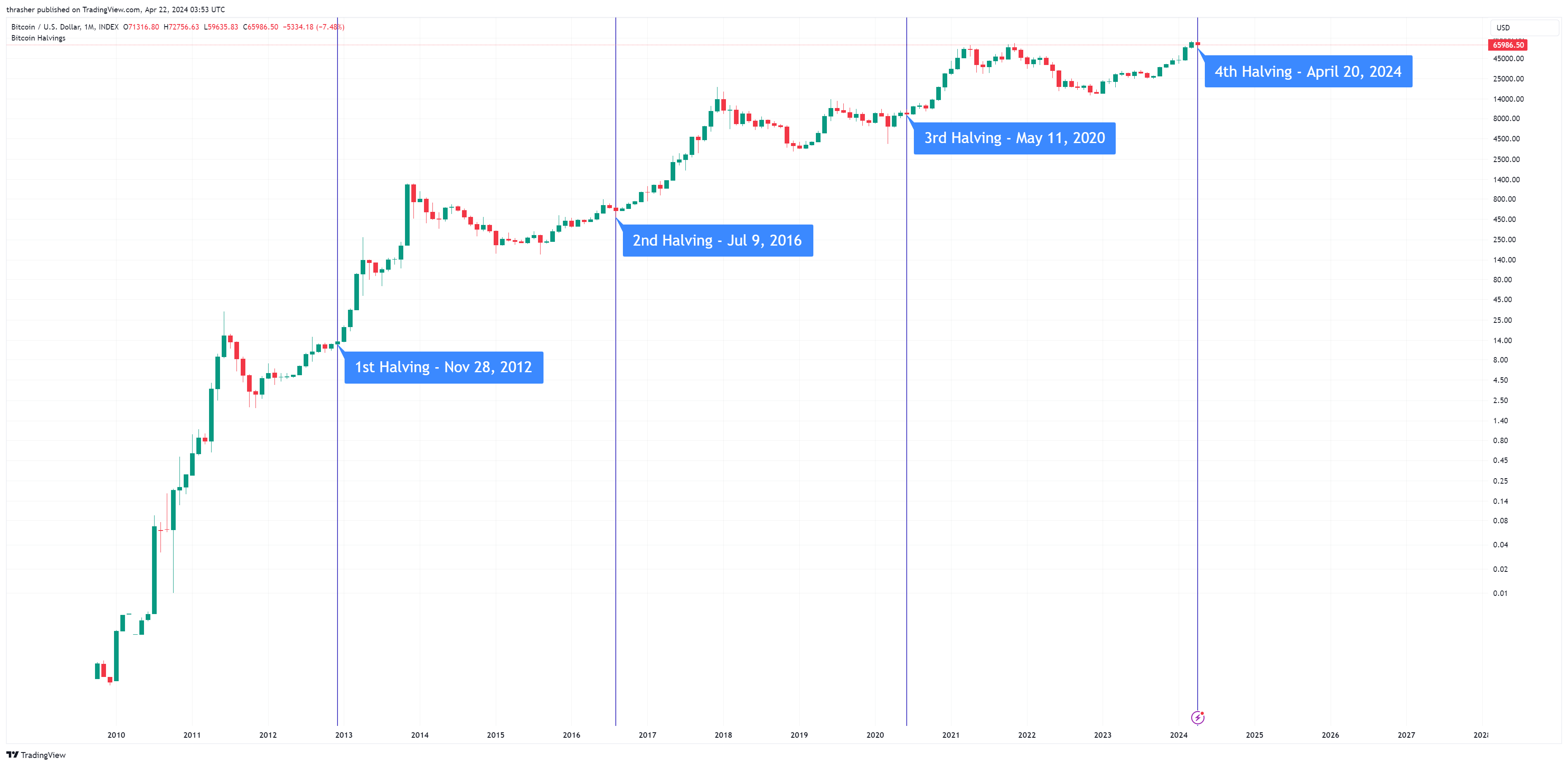

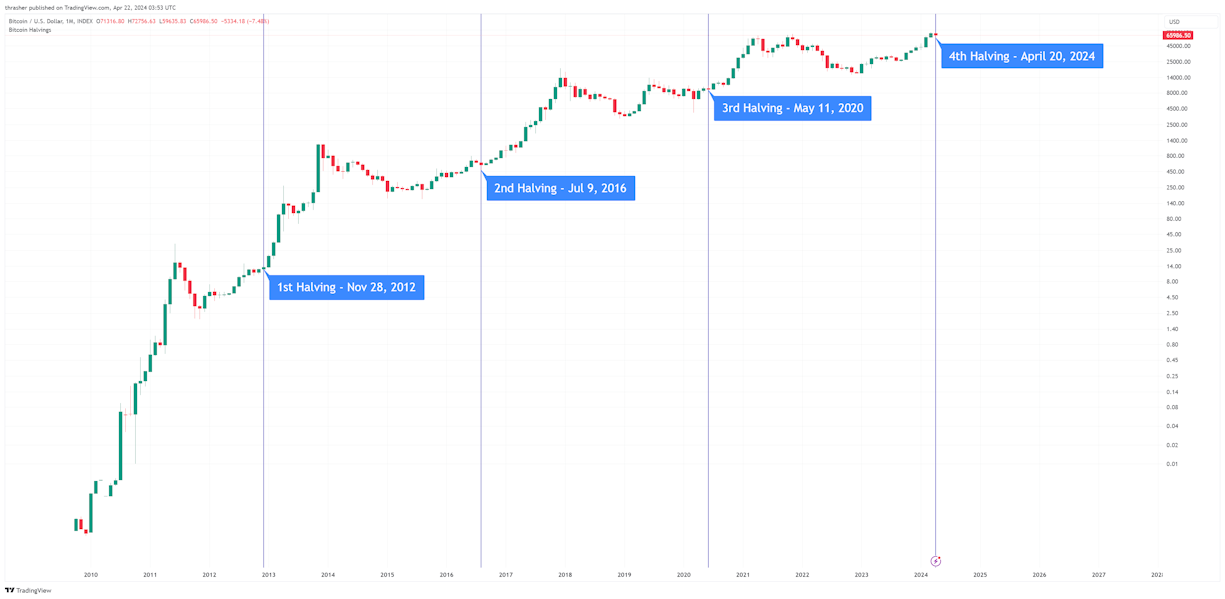

Credit: www.tradingview.com

Current Market Trends

Bitcoin has been a hot topic in the financial world. Investors and traders keep a close eye on its market trends. Understanding current trends can help predict future prices. Let’s dive into recent movements and market sentiment.

Recent Price Movements

Bitcoin’s price has seen many ups and downs recently. Last month, it hit a new high. Soon after, it experienced a sharp drop. Such movements are not unusual for Bitcoin. It often shows sudden spikes and dips. This volatility attracts many traders. They see opportunities to buy low and sell high. Tracking these movements helps in making informed decisions.

Market Sentiment

Market sentiment plays a big role in Bitcoin prices. Many factors influence how people feel about Bitcoin. News can cause big shifts. Positive news can drive prices up. Negative news can lead to drops. Social media buzz also affects sentiment. Influencers can sway public opinion. This collective mood impacts the buying and selling behavior. Keeping a pulse on market sentiment is crucial for any Bitcoin investor.

Factors Influencing Bitcoin Price

Bitcoin price prediction is a hot topic. Many factors influence Bitcoin’s price. Understanding these factors can help you navigate the market better. Let’s explore some key elements that impact Bitcoin’s value.

Regulatory Changes

Regulatory changes have a big impact on Bitcoin prices. Governments around the world create rules for cryptocurrencies. These rules can either boost or harm Bitcoin’s value. For instance, a country banning Bitcoin can lead to a price drop. On the other hand, supportive regulations can increase its value. Keep an eye on news about regulations. This will help you predict market movements.

Technological Advancements

Technological advancements also affect Bitcoin prices. Innovations in blockchain technology can enhance Bitcoin’s functionality. These changes can make Bitcoin more attractive to investors. For example, improvements in transaction speed can boost its demand. Security upgrades can also increase trust in Bitcoin. As technology evolves, Bitcoin’s value may rise. Stay updated on tech news to understand these trends.

Credit: www.swanbitcoin.com

Expert Opinions

Bitcoin price predictions often vary due to its volatile nature. Experts share their insights to help understand potential future trends. Their opinions are based on various factors influencing the market.

Key Influencers In The Market

Several key influencers impact Bitcoin prices. These include major investors, government regulations, and technological advancements. They shape market sentiment and drive price movements.

Major investors, often called whales, can move the market significantly. Their buying or selling actions create large price swings. Government policies also play a vital role. Regulatory changes can boost or hinder Bitcoin adoption.

Technological advancements affect Bitcoin’s value. Innovations in blockchain technology can enhance its utility. This can lead to increased demand and higher prices.

Predictions From Top Analysts

Top analysts provide varied Bitcoin price predictions. Their forecasts depend on market trends and data analysis. Some predict bullish trends, while others foresee corrections.

For instance, some analysts see Bitcoin reaching new highs. They base their predictions on increased institutional adoption. Others highlight potential risks. They warn about regulatory crackdowns and market corrections.

Despite differing views, most analysts agree on one point. Bitcoin will remain a significant player in the cryptocurrency market.

Technical Analysis

Technical analysis is a common method for predicting Bitcoin prices. It involves studying past price movements to forecast future trends. Traders use various tools and techniques to analyze Bitcoin’s price. Let’s explore some key aspects of technical analysis.

Chart Patterns

Chart patterns are visual representations of price movements. They help traders predict future price action. Here are some popular chart patterns:

- Head and Shoulders: Indicates a trend reversal.

- Double Top and Bottom: Shows a change in direction.

- Triangles: Suggests continuation or reversal, depending on the type.

Using these patterns, traders can make informed decisions. Identifying the right pattern can lead to profitable trades.

Indicators And Signals

Indicators and signals are mathematical calculations based on price, volume, and other factors. They help traders understand market trends. Some popular indicators include:

- Moving Averages (MA): Shows the average price over a specific period.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- MACD (Moving Average Convergence Divergence): Indicates changes in the strength, direction, momentum, and duration of a trend.

These indicators generate signals to guide trading decisions. For example, a rising RSI above 70 may signal an overbought condition, while an RSI below 30 may indicate an oversold condition.

Combining chart patterns with indicators can enhance the accuracy of predictions. This holistic approach helps traders better understand market behavior.

Fundamental Analysis

Fundamental analysis involves examining the core factors that influence Bitcoin’s price. It looks at the technology, development, and market sentiment. This analysis helps predict future price movements based on real-world events and trends.

Bitcoin Adoption Rates

Bitcoin adoption rates are a key factor in price prediction. More people using Bitcoin increases demand, pushing prices up. Adoption can be seen in retail, online transactions, and even countries accepting Bitcoin as legal tender. The wider the adoption, the higher the potential price. Tracking this can provide valuable insights into future price movements.

Institutional Investments

Institutional investments play a significant role in Bitcoin’s price. Large financial institutions investing in Bitcoin can lead to substantial price increases. These investments bring credibility and stability to the market. Watching these investments can help predict price trends. Institutional interest often signals long-term confidence in Bitcoin. This can lead to sustained price growth over time.

Potential Risks And Challenges

Bitcoin price prediction carries potential risks due to market volatility. Regulatory changes and technological issues can also impact prices. Investors should stay informed and cautious.

Bitcoin price prediction can be exciting. Yet, it comes with potential risks and challenges. Understanding these can help in making informed decisions.Market Volatility

Bitcoin is known for its market volatility. Prices can swing wildly in a short time. This makes predicting prices difficult. One day, the value might soar. The next, it could plummet. Such swings can be stressful for investors. It’s crucial to be prepared for these ups and downs.Security Concerns

Security is a big concern in the crypto world. Hackers often target exchanges and wallets. This can lead to loss of funds. Keeping Bitcoin safe requires strong security measures. Always use trusted platforms and secure wallets. Educate yourself about phishing scams and malware. Being vigilant can protect your investments. “`Future Outlook For 2024

The Bitcoin price prediction for 2024 is a hot topic among investors. With the volatile nature of cryptocurrency, the future outlook can be both exciting and uncertain. In this section, we will delve into both optimistic and pessimistic scenarios for Bitcoin’s price in 2024.

Optimistic Scenarios

Several factors could lead to a positive outlook for Bitcoin in 2024. Here are some key points:

- Increased Adoption: More businesses and individuals may start using Bitcoin.

- Regulatory Clarity: Clearer regulations could boost investor confidence.

- Technological Advancements: Improvements in blockchain technology can enhance Bitcoin’s appeal.

Experts believe that these factors can push Bitcoin’s price higher. Let’s take a look at some predictions:

| Analyst | Predicted Price |

|---|---|

| Expert A | $100,000 |

| Expert B | $120,000 |

| Expert C | $150,000 |

Pessimistic Scenarios

While there are many reasons to be optimistic, some factors could lead to a negative outlook. Here are a few:

- Regulatory Crackdowns: Governments may impose stricter regulations on Bitcoin.

- Security Concerns: Cyber-attacks and hacks could deter investors.

- Market Volatility: Extreme price swings can scare off potential buyers.

These factors could result in lower Bitcoin prices. Here are some pessimistic predictions:

| Analyst | Predicted Price |

|---|---|

| Expert X | $20,000 |

| Expert Y | $15,000 |

| Expert Z | $10,000 |

Understanding both optimistic and pessimistic scenarios can help in making informed investment decisions. The future of Bitcoin in 2024 remains uncertain, but being prepared for any outcome is crucial.

Credit: www.forbes.com

Frequently Asked Questions

What Affects Bitcoin Price Prediction?

Bitcoin price prediction is influenced by market demand, investor sentiment, regulatory news, and technological advancements. These factors can cause significant price fluctuations.

How Accurate Are Bitcoin Price Predictions?

Bitcoin price predictions vary in accuracy due to market volatility. Analysts use historical data and trends, but results are not guaranteed.

Can Bitcoin Reach $100,000?

Many analysts believe Bitcoin can reach $100,000. Market trends, adoption rates, and institutional investments drive this possibility.

Is Bitcoin A Good Investment?

Bitcoin can be a good investment due to its potential for high returns. However, it carries significant risk due to volatility.

Conclusion

Predicting Bitcoin prices is challenging but intriguing. Trends and patterns offer insights. Stay informed and track news. Understand risks before investing. Bitcoin’s future is uncertain, yet promising. Educate yourself and make smart choices. Embrace the volatility with caution. Stay updated and engaged.

Your financial journey with Bitcoin can be rewarding. Keep learning. Stay curious.